The total in Box 3 should not be more than the maximum social security wage base for that tax year. These are the total wages paid that are subject to social security. This is the total federal income tax withheld from your pay during the year. The above listed taxable fringe benefits are shown in Box 14. These amounts are shown in Boxes 12 and 14. Your taxable wages are reduced by contributions to deferred compensation and/or tax deferred annuity accounts, pension plan, Commuter Benefits, and other programs that are not subject to federal taxes. Domestic Partner Health Insurance Premiums.Commuter Benefits Administrative Fringe Fee.The taxable wages consist of the gross wages and other compensation paid to you during the year, including the following taxable fringe benefits: You need it for filing federal and New York State tax returns. These are your taxable wages during the year. You should change your home address in NYCAPS Employee Self-Service (ESS) or report address changes to your agency. If your address is incorrect, you can still use the W-2. If your name is incorrect, you should notify your agency. You can report a name change to SSA by calling 1-80. If your name changes, your earnings cannot be posted by SSA until your social security records are updated. This box shows your name and address which is currently in the City's Payroll Management System.

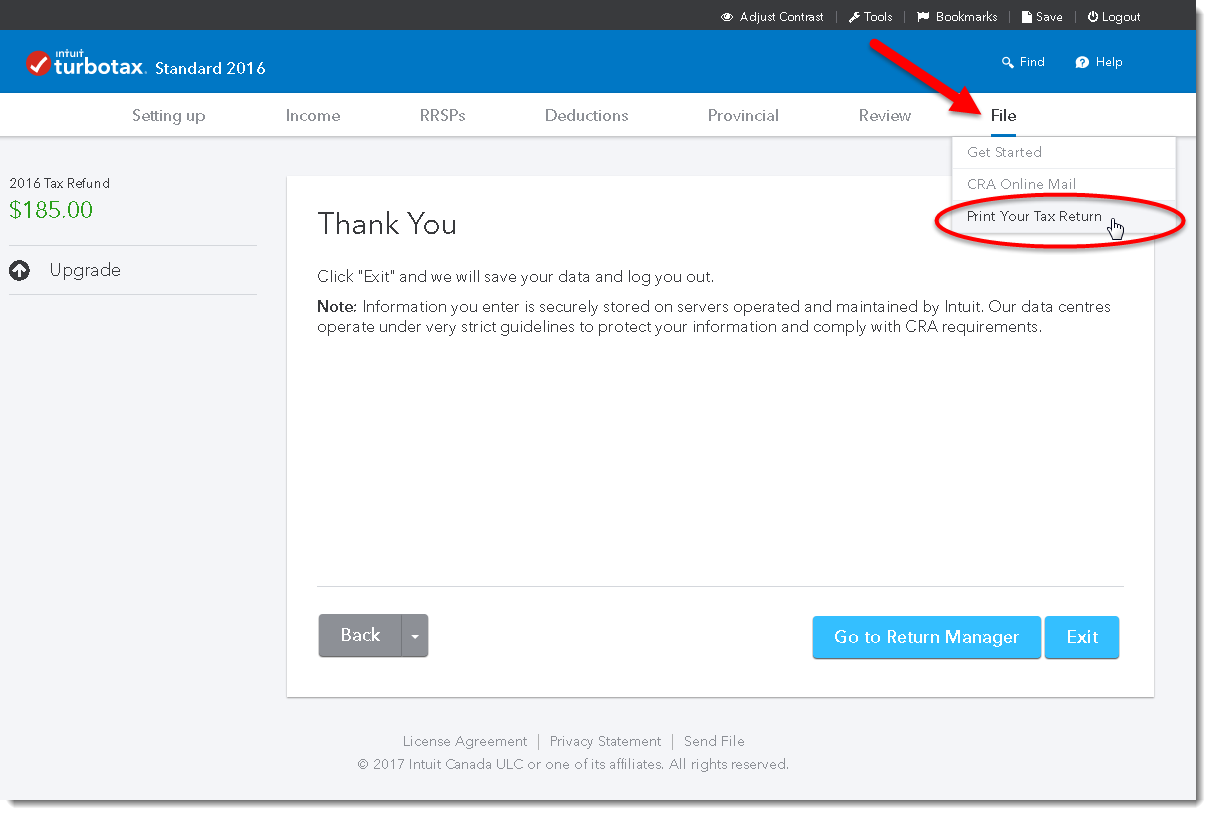

Turbotax return summary page code#

Boxes e, f: Employee's first name and initials, Last name, Suff., Employee’s address and ZIP code This box shows your agency's payroll number and payroll distribution code to assist in the distribution of W-2s. This is your employer's information for tax reporting purposes. Box c: Employer's name, address, and ZIP code This is the Employer Identification Number assigned by the IRS to The City of New York, Department of Education, City University of New York, New York City Housing Authority, or New York City Municipal Water Finance Authority. Box b: Employer identification number (EIN) OPA will verify your information with the Social Security Administration and then issue a corrected W-2. The Personnel Office will forward a copy of your social security card to OPA along with a W-2 Duplicate Request Form or a W-2 Correction Request Form. If your SSN is incorrect, present your social security card to your Personnel Office immediately. The Social Security Administration uses your SSN to record your earnings for future social security and Medicare benefits. The IRS uses your social security number (SSN) to verify the data it receives from the City against the amounts shown on your tax returns. Box a: Employee's social security number The City sends wage and tax information to the Social Security Administration and the New York State Department of Taxation and Finance.

This is the calendar year covered by the W-2. Your W-2 Wage and Tax Statement itemizes your total annual wages and the amount of taxes withheld from your paycheck. In the selection list highlight IP PIN and click GO.The W-2 form is a United States federal wage and tax statement that an employer must give to each employee and also send to the Social Security Administration (SSA) every year.In the Tools window choose TOPIC SEARCH.Once the return is open, click at the top on MY ACCOUNT, then choose TOOLS.Next screen asks: "Did you or any of your dependents get an IP PIN from the IRS for this year's taxes?".Choose Identity Protection PIN and Start (or Revisit.).Once the return is open, then go to the Federal Taxes tab.Log in and open your return ("Take me to my return").Here are two ways to navigate to the section to enter the 6 digit IP PIN: A new IP PIN will be generated each year. From the IRS : The IRS IP PIN is a 6-digit number assigned to eligible taxpayers to help prevent the misuse of their Social Security number on fraudulent federal income tax returns.

0 kommentar(er)

0 kommentar(er)